GENIUS Act just signed; what next? CLARITY @a16zcrypto

"At the White House today, the first major piece of U.S. crypto legislation was just signed into law:The GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act),

which provides clear rules for stablecoins.

It recently passed both the Senate and House of Representatives with broad bipartisan support.

This is a historic moment — not just for crypto, but for the world at large.

That’s because stablecoins give us something we’ve never really had before:

open money infrastructure.

Stablecoins are a better form of money: faster, cheaper, and more global.

They cut fees and eliminate intermediaries. They are auditable and programmable.

They allow developers to build new kinds of apps that weren’t possible before:

low-to-no cost remittances, programmatic micropayments, AI-native transactions, transparent and disintermediated global commerce, and more."

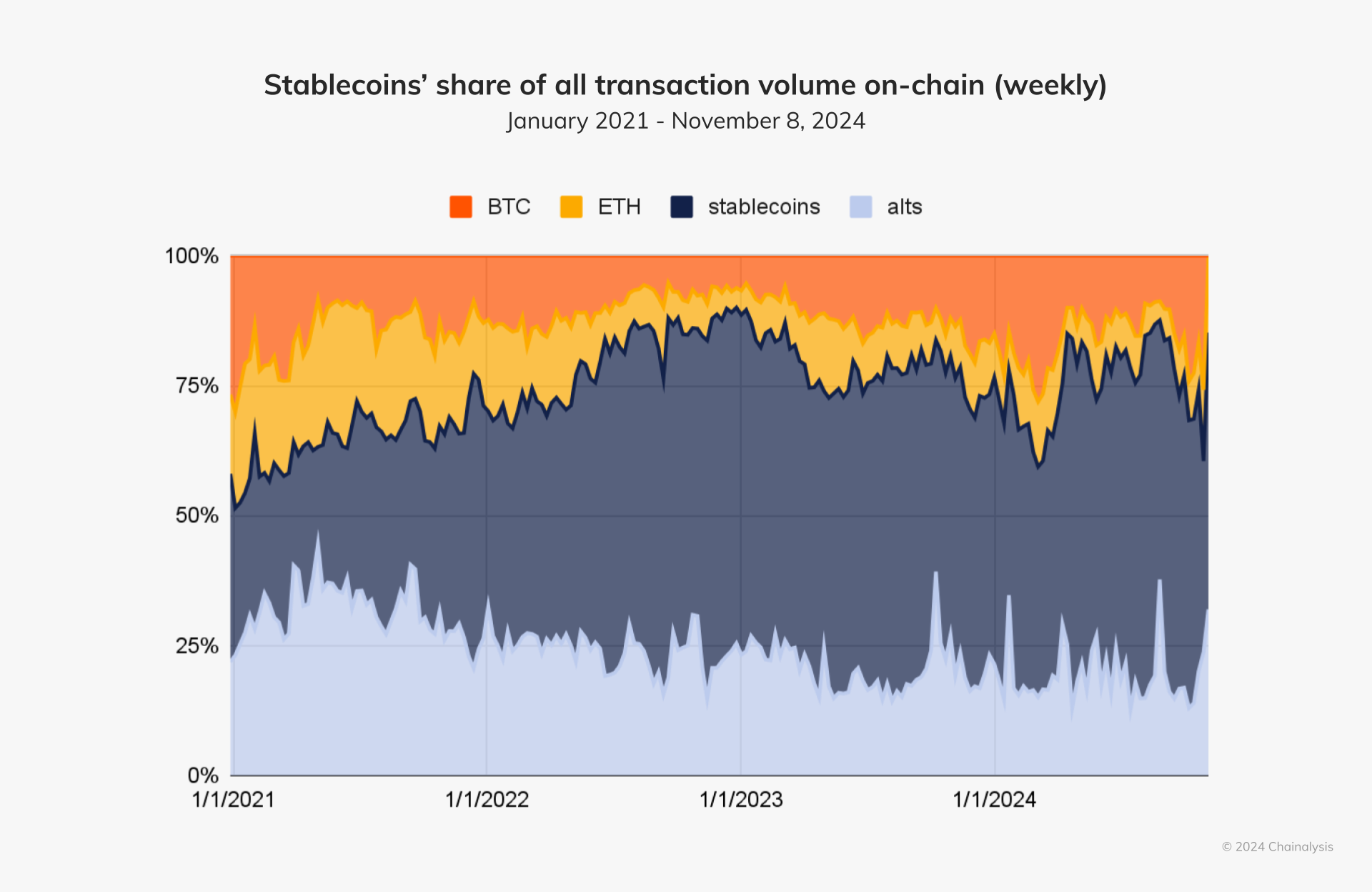

Stablecoins are a type of cryptocurrency designed to have a stable value, often pegged to a fiat currency like the US dollar, while Bitcoin is known for its price volatility.

Stablecoins are cryptocurrencies designed to minimize price volatility by being pegged to a stable asset like the US dollar. Examples include Tether (USDT), USD Coin (USDC), and Dai (DAI).

Here's a more detailed look:

Fiat-backed stablecoins: These are backed by fiat currencies, meaning for every stablecoin issued, there's a corresponding amount of fiat currency held in reserve.

Tether (USDT): One of the oldest and largest stablecoins, pegged to the US dollar.

USD Coin (USDC): Another popular stablecoin, also pegged to the US dollar, and known for its transparency and regulatory compliance.

TrueUSD (TUSD): Another US dollar-pegged stablecoin, known for its regular audits.

Paxos Standard (PAX): A stablecoin also pegged to the US dollar, issued by Paxos.

Crypto-collateralized stablecoins: These are backed by other cryptocurrencies, often using smart contracts to manage collateral and maintain price stability.

Dai (DAI): A decentralized stablecoin, collateralized by other cryptocurrencies, and pegged to the US dollar.